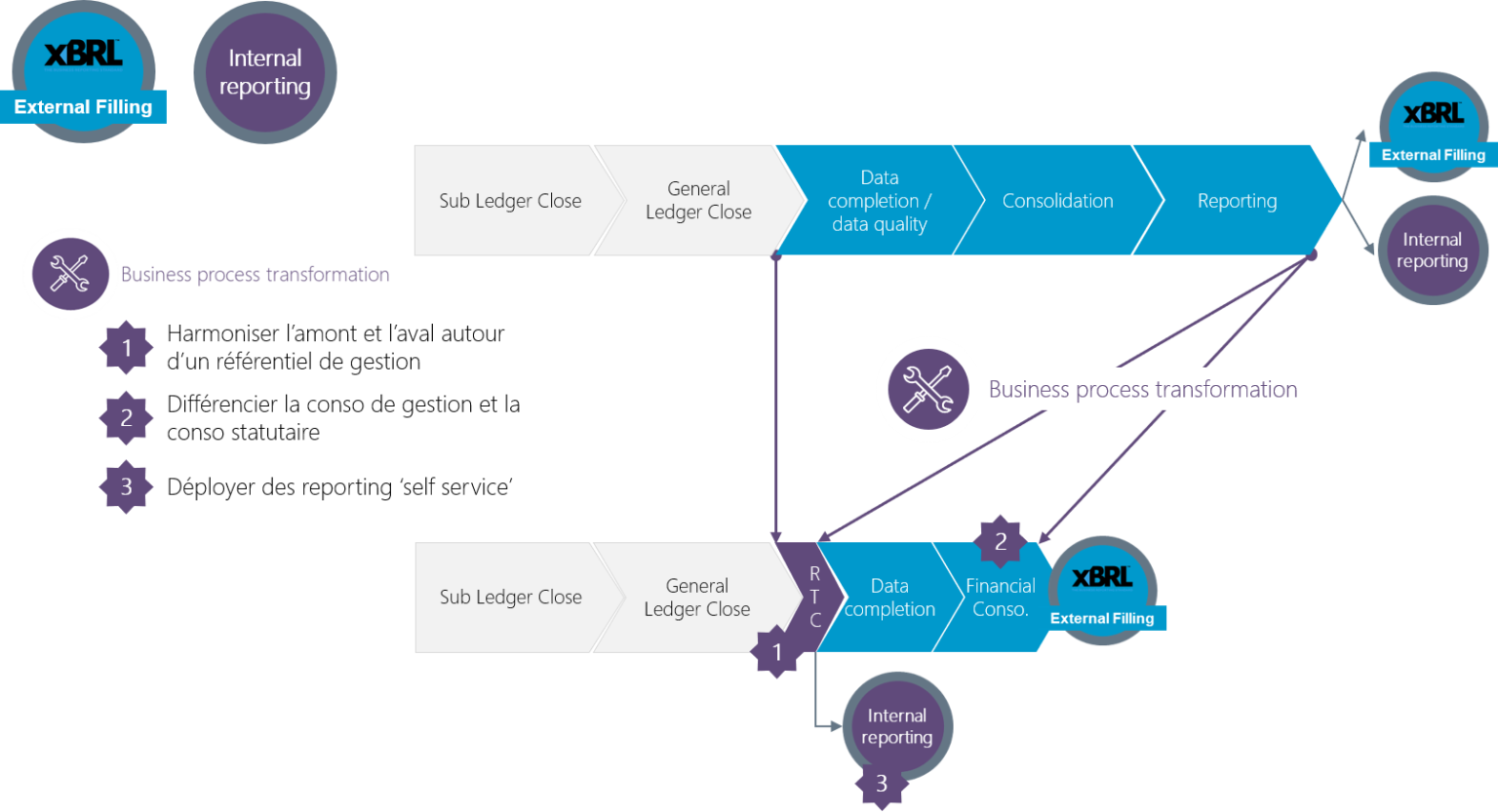

RTC is a simple acronym that sums up the ambitions of finance departments in terms of Record to Report: fluid general and analytical accounting, stopped monthly, and a simplified consolidation process with instantaneous reporting.

The expected benefits are well known. The aim is to reduce information production times and costs, and to integrate systems to improve the audit trail and data consistency.

This is not a new idea, and attempts have been made for over 30 years to achieve these objectives through Lean Accounting or Fast Close projects; many groups now close their books in just a few days. However, with RTC, this is the first time that the consolidation and reporting process has been turned upside down to this extent, and that’s what makes the approach so interesting.

Here are the 3 levers that will enable you to implement an RTC approach, while creating agility:

- Harmonise the upstream and downstream processes around a management reference framework

- Differentiate between financial and management consolidation

- Deploy self-service reporting

Harmonize upstream and downstream around a management framework

Transactional and decision-making tools are still very far apart in terms of content. This leads to :

- Complex interfaces: The solution? Use a common management repository for the entire organisation. This makes it possible to move more flexibly from one universe to another, thereby ensuring model consistency. For example, a local chart of accounts that fits into the group chart of accounts, or cost centres that, once aggregated, reflect the value chain.

- Manual data entry: the solution? Take all the notes out of the BTI process. The aim is to quickly produce key elements for management, for example, those that contribute to operating profit or free cash flow. So forget about analysing deferred tax, the fair value revaluation of financial assets or provisions for retirement. On the other hand, you can automate the generation of free cash flow by integrating the notion of changes in fixed assets into general accounting, for example using the fixed asset management module.

- Numerous quality controls and validation workflows: the solution? Once the accounting department has produced a quality closing, it is no longer necessary to make manual corrections in the consolidation tool. The best practice is still to close the accounts in the general ledger rather than in the reporting system. Of course, you can’t rule out some back-and-forth, but with data loading and consolidation times of no more than a few minutes and two or three clicks, it becomes easier to make the final entries in the general ledger.

Differentiate between financial and management consolidation

Since the 1980s and 1990s, it has been systematically recommended to unify statutory and management consolidations. However, this does not mean that they should be placed on the same level and subject to the same constraints.

For example, a management consolidation does not necessarily require the automatic processing of companies accounted for by the equity method, financial consolidation does not require to be produced in 3 days.

Differentiating the two needs, while maintaining a strong articulation, will make it possible to put the analysis of the business back at the centre and give room for manoeuvre to management control. It is not necessary to talk about separation here, just differentiation.

Management consolidation is primarily used to analyse performance, to disseminate key indicators internally and to feed into dashboards. She needs:

- Many dimensions of analysis, allocation keys

- Flexibility in the data model

- To be produced in real time, every month

- Comparisons with the forecasting phases

However, it does not need to be exhaustive and can focus on items such as operating income, available cash flow or main operating entities.

Financial consolidation is used for external communication (with shareholders, for example), financing and restructuring operations or mergers and acquisitions. It requires:

- Be exhaustive (Statement of Comprehensive Income, full legal scope)

- Include detailed analyses of financial items (debts, long-term leases, etc.) and current and deferred taxes

- To include all the notes to the financial statements, and therefore to treat a great heterogeneity of information (fair values, off-balance sheet, extra accounting analyses)

It is entirely possible to harmonize the two processes, to articulate them fully and automatically, while ensuring that they are supported by two separate reporting cycles.

Deploy self-service reporting

By working on the first two components, some groups have already drastically reduced delays. But on the last kilometre, the production of self-service reports, it is still very rare to see the financial departments change gears. This is an acute problem of change management.

However, it is useless to do BTI if it then takes a week to compile hundreds of tables in a file and send them by email. To remove the last blockages, ergonomic reporting tools must be implemented with:

- The possibility to download the tables online

- Notifications in case of data updates

- The opportunity to comment

But above all, it would be necessary to rely on a shared management framework and simplified data models, allowing drag & drop and drill through.

Some of these tools already exist. But organizations have difficulty accepting the idea that reports must be easy for non-experts to use in order to be self-service. However, there is indeed a need to review and simplify the very content of some reporting to achieve the objective of self-service.

By implementing a PSTN approach, you benefit from the investments made upstream.

You benefit fully from the efforts made to quickly close the general and cost accounting by adopting a Real Time Consolidation approach to this data. You reduce your lead times and costs while increasing the linearity of accounting processes. Monthly closing becomes routine and relies almost entirely on the accounting department, there is no need to go back and forth with the reporting system.

By articulating financial and management consolidation differently, you put business back at the centre with a wider and faster dissemination of information on this scope and an emphasis on business-oriented financial indicators (working capital, capex, operating profit…). The link with more operational reporting such as sales, for example, is strengthened, and you can rely on a finer granularity for management data.

In conclusion, with the RTC, management control is back on track. He comments and analyses the results with the activity managers rather than compiling tables and all actors share the same information at the same time.